Propbase Roadmap

A game changing

experience awaits

In 2026, Propbase delivers a unified infrastructure to scale real estate investing on-chain—introducing mobile-first apps, embedded wallets, auto-compounding yield, P2P lending, cross-chain access via LayerZero, and institutional-grade asset aggregation through the XPROPS index.

PROPBASE TECHNICALROADMAP 2026

Own a share of high-quality, resilient real estate with as little as $100. Propbase makes real estate investing accessible through fractional ownership, opening the doors to a new era of wealth-building.

Q1 2026FOUNDATIONTO SCALE

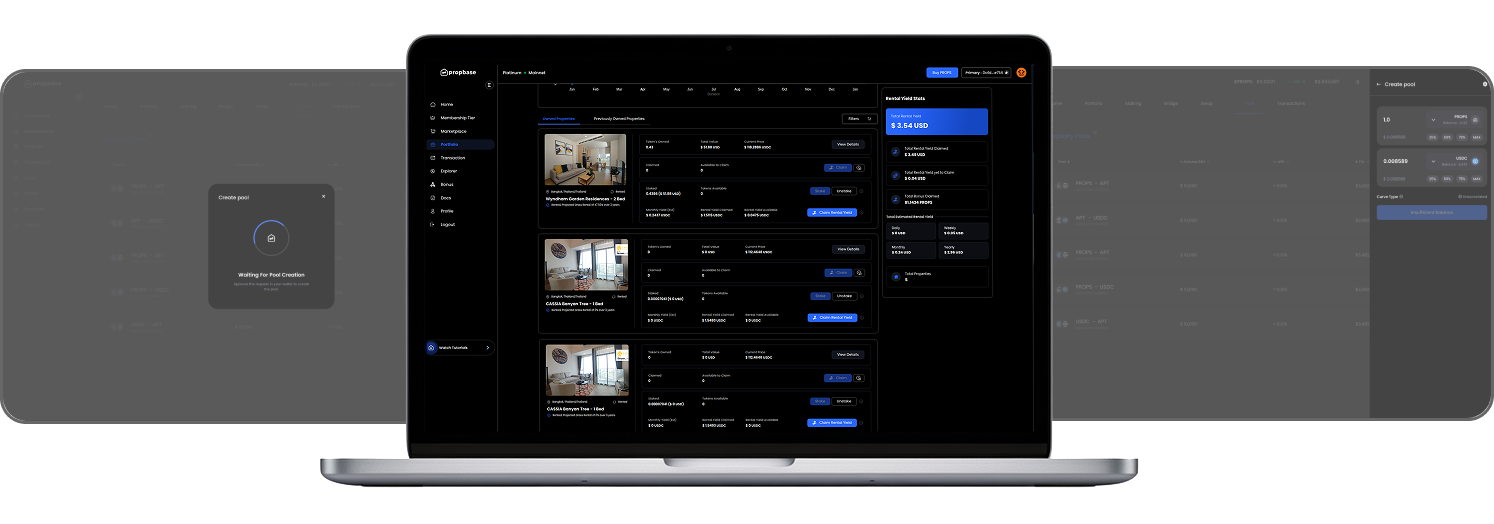

Built through focused execution in 2025, the products below reflect Propbase's clear conviction and disciplined focus on exactly what to build, forming the foundation for scaled production deployments beginning in Q1 2026.

"Building the unified infrastructure to scale Propbase end-to-end"

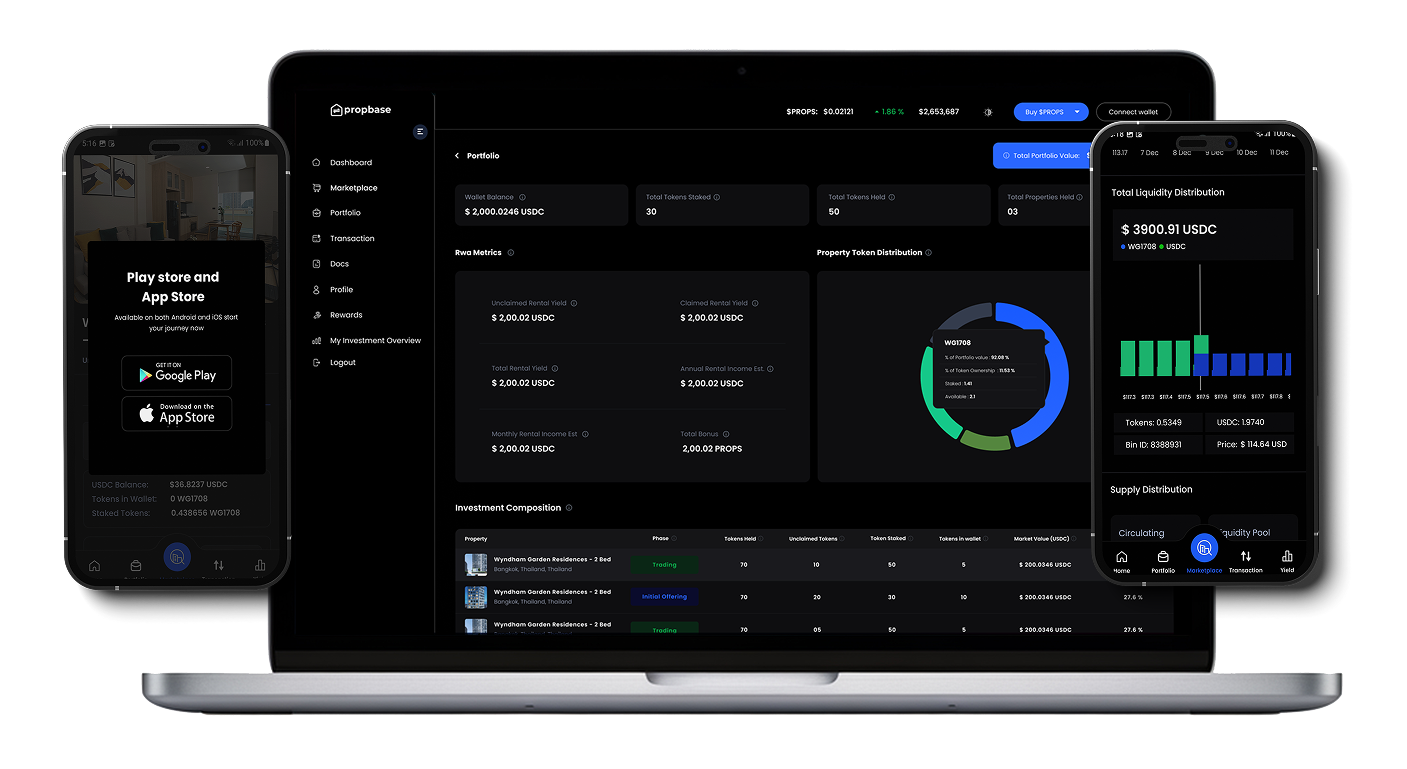

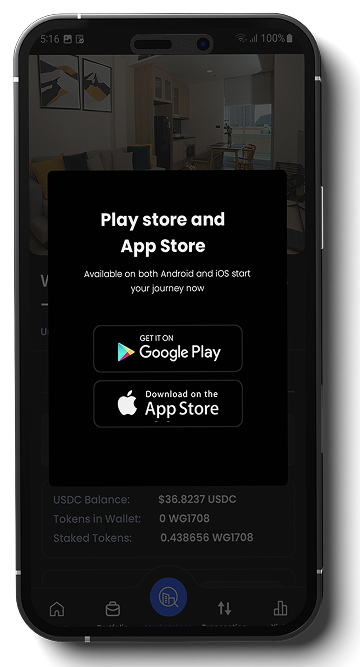

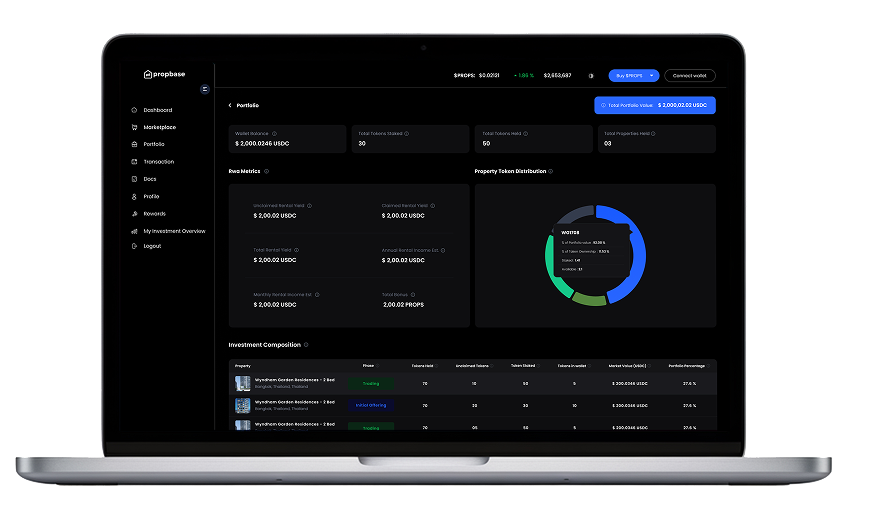

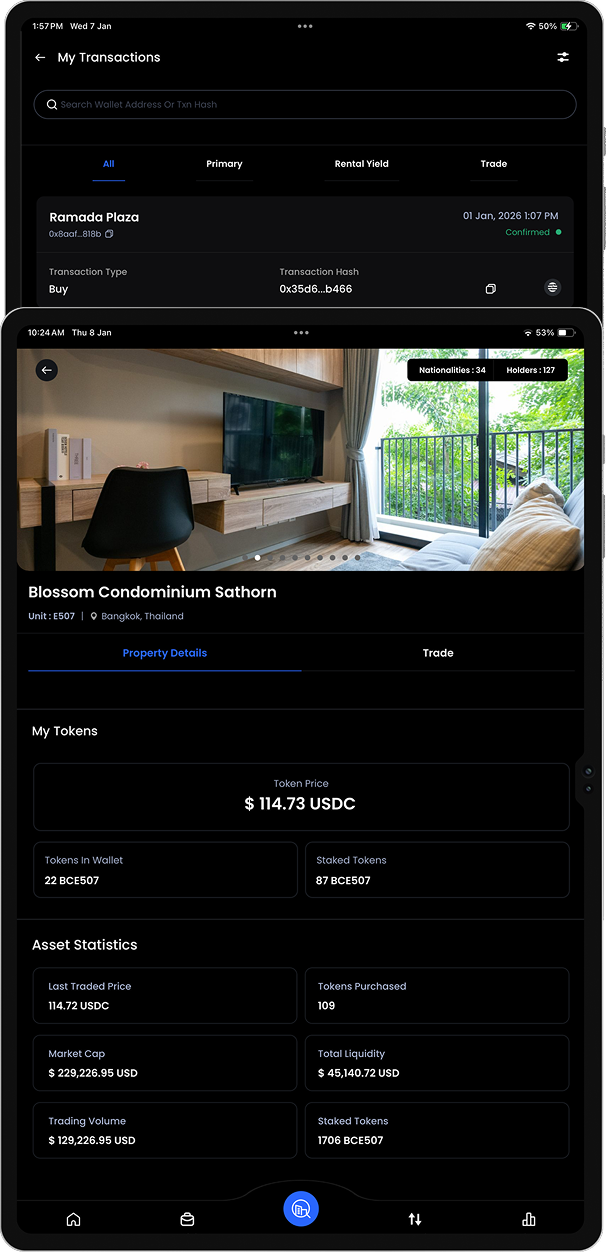

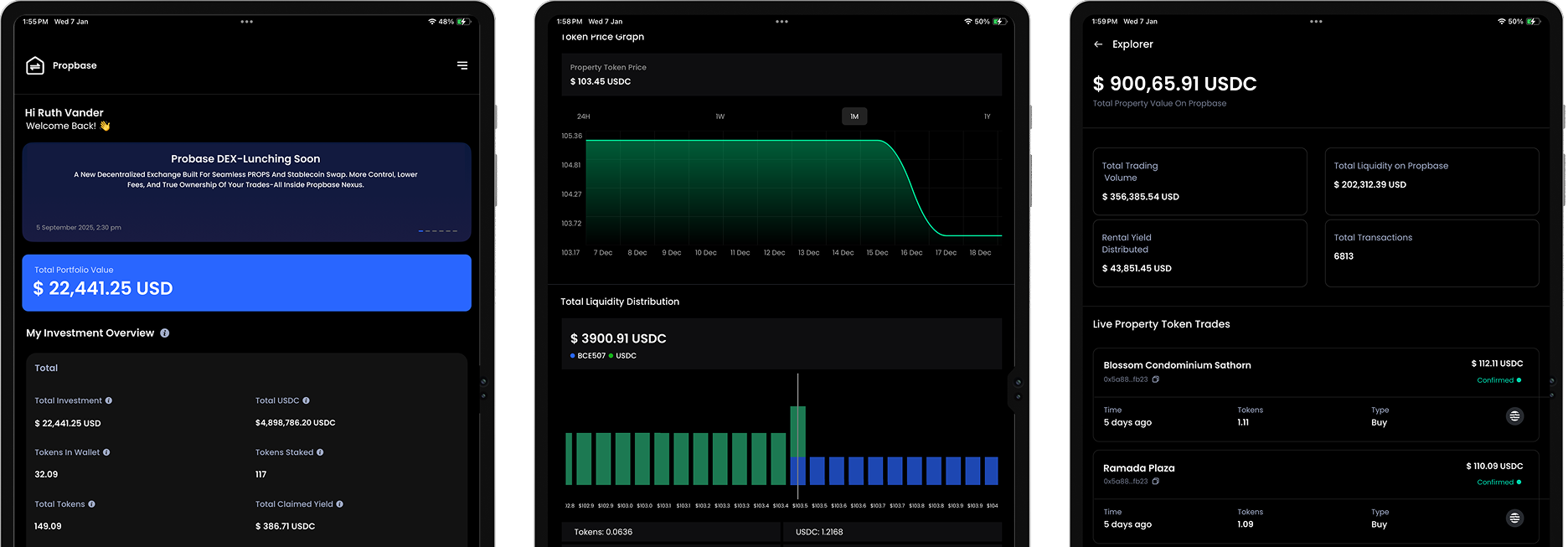

User Experience & Application Layer - Mobile Application Release (iOS & Android)

- Cross-platform mobile application deployment

- Embedded Petra wallet transaction flows

- Real-time portfolio and asset data pipelines

- Secure authentication and account lifecycle management

Yield Automation & Capital Efficiency - Auto-Compounding Rental Yield

- Develop a dedicated auto-compounding contract linked to property staking

- Implement scheduled execution based on staking timestamps and intervals

- Integrate secondary marketplace execution for automated token purchases

- Handle partial fills, execution failures, and idle yield fallback

- Extend portfolio accounting for real-time compounded and staked balances

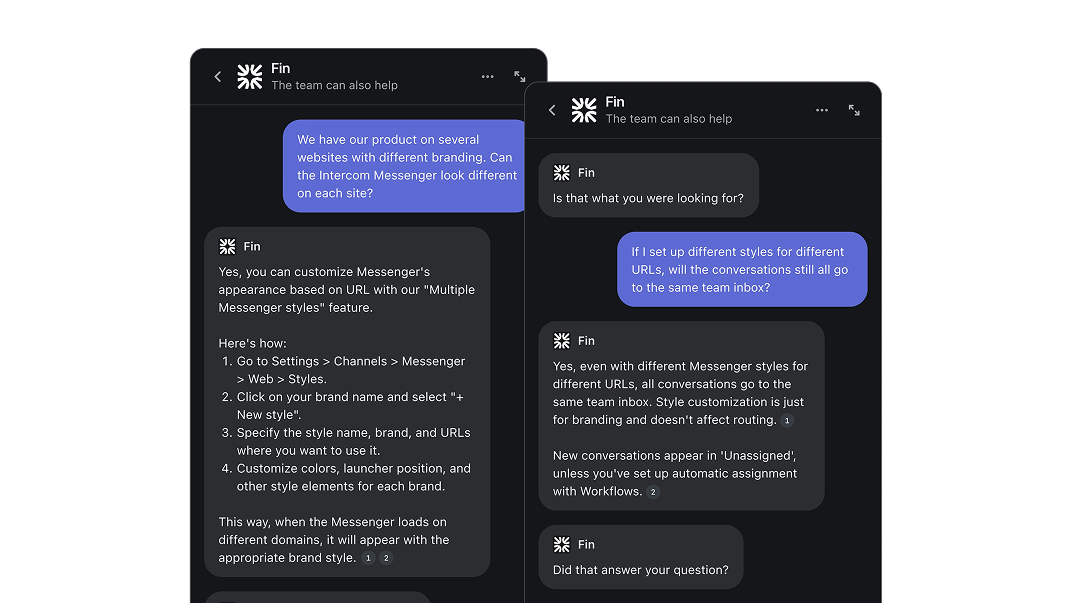

Customer Support & Engagement Layer - Intercom In-App Support & Live Chat

- In-app messaging SDK integration and lifecycle management

- Telegram support channel integration and synchronization

- AI-powered intent classification and response assistance

- Live agent handoff, routing, and escalation logic

- Support performance analytics and resolution tracking

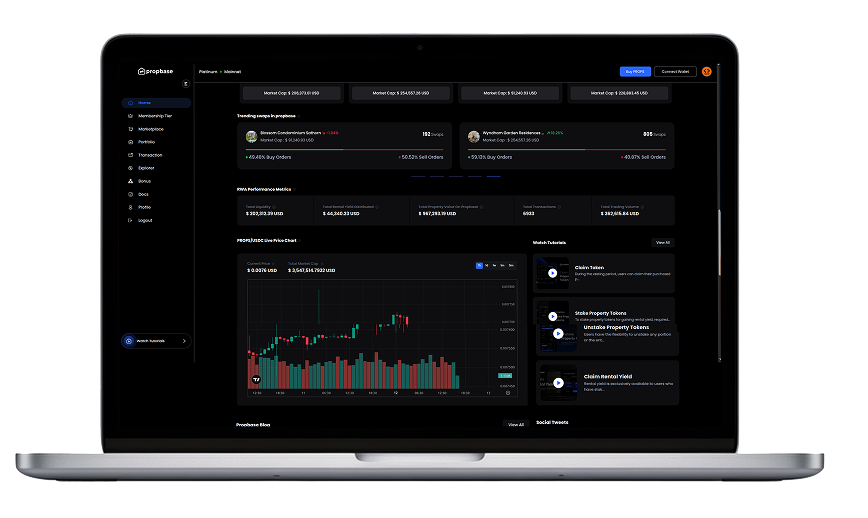

Liquidity & Market Infrastructure - PROPS DEX AMM (USDC/PROPS)

- Automated market maker smart contract deployment

- Permissionless, community-driven liquidity provisioning

- USDC / PROPS pool architecture and swap execution logic

- Liquidity incentives, farming mechanisms, and PROPS reward distribution

- LP position tracking, fee accounting, and performance analytics

- Additional PROPS utility through liquidity participation, serving as the primary on-platform entry point for new ecosystem participants, with farming incentives rewarding long-term contributors

2026 Q1 Summary

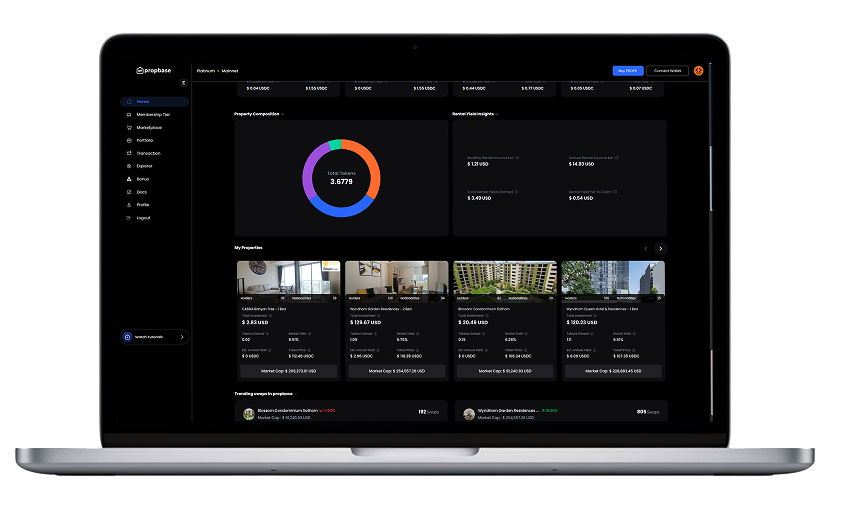

Q1 2026 marks a major step in making Propbase more accessible, efficient, and self-contained. The mobile application release enables a smooth onboarding experience for non-native crypto users, supported by familiar sign-up flows, in-app transactions, and clear portfolio dashboards. Integrated in-app support provides real-time communication through professional channels, giving web2 users confidence and immediate assistance when navigating the platform.

At the protocol level, yield automation introduces capital

efficiency for existing users by reducing manual actions and enabling automated reinvestment workflows. In parallel, the launch of the Props amm within Propbase removes the need for external exchanges, allowing users to acquire Props directly inside the ecosystem.

Together, these releases move Propbase closer to its core mission: a single, seamless platform for discovering, managing, earning, and transacting across real-world assets-without leaving Propbase.

Q2 2026UTILITY AT SCALE

Q2 2026 focuses on scaling real, on-platform utility across the Propbase ecosystem. This phase removes remaining onboarding friction through embedded wallets, expands practical use cases for property tokens, and reinforces intended platform behavior through structured incentives—all delivered within a single, unified Propbase experience.

"Fast onboarding, deeper token utility, and all Propbase activity in one place"

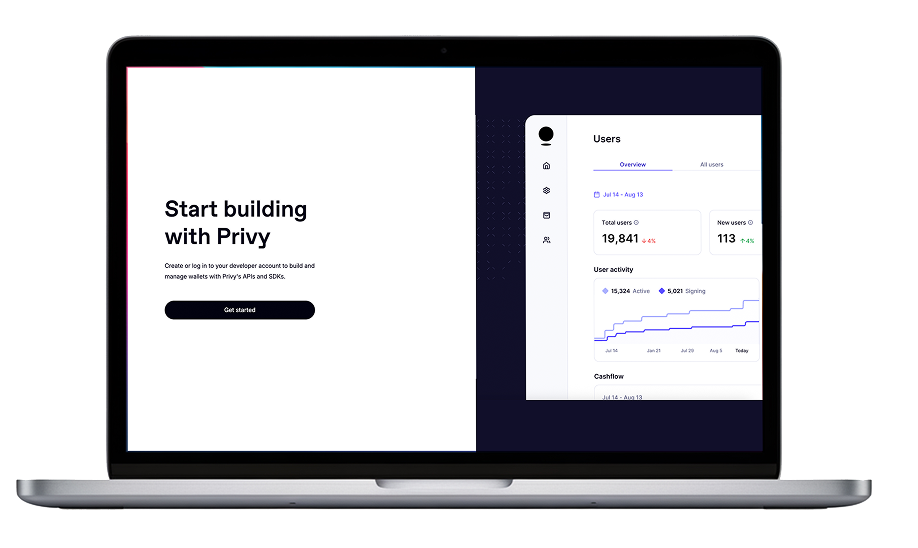

User Experience & Onboarding Infrastructure - Embedded Wallet Integration

- Privy-powered embedded wallet integration

- Email-based authentication and key abstraction

- Integrated fiat on-ramp with automated gas handling

- Simplified transaction execution with flat-fee logic

- Optional usage alongside external self-custodial wallets

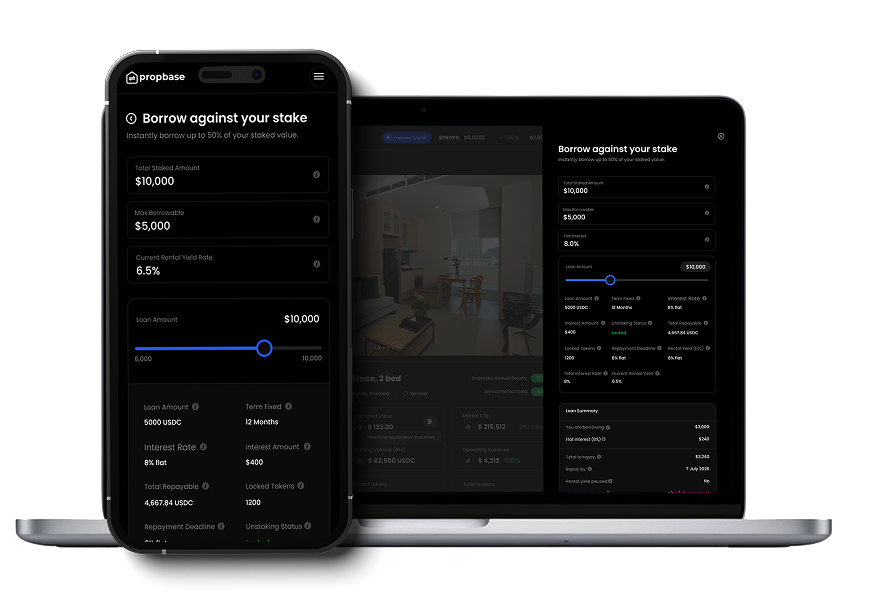

Capital Efficiency & Credit Access - Propbase Lend 1.0

- Rental yield contract extension for token pledging

- Asset locking and pledge state management

- Deterministic LTV-based USDC issuance

- Fixed-rate interest accounting (non-liquidation)

- Protocol-managed loan wind-down lifecycle integration to 2.0

Token Utility & Rewards - Propbase Utility Engine

- Event-driven user action tracking and attribution rewards system

- Rule-based utility modifiers and eligibility logic

- PROPS Incentive issuance and accounting module

- Behavior state tracking across holding, trading, and staking

- Configurable rules engine for future rewards campaigns

2026 Q2 Summary

By the end of Q2 2026, Propbase enables users to onboard in minutes, access liquidity without selling assets, and unlock meaningful utility from property tokens through incentives and on-platform participation. Together, these upgrades deepen engagement for core users, improve capital efficiency, and reinforce Propbase's commitment to building decentralized, easy-to-use products with enhanced real-world utility.

Q3 2026SCALE WITHVELOCITY

Q3 2026 focuses on accelerating how users access, trade, and interact across the Propbase ecosystem. With core infrastructure and utility firmly in place, this phase emphasizes speed, reach, and execution removing cross-chain friction, unifying product experiences, and introducing more advanced on-chain trading functionality to support higher activity and deeper liquidity across property tokens.

"Speed, Access, Execution - At Scale."

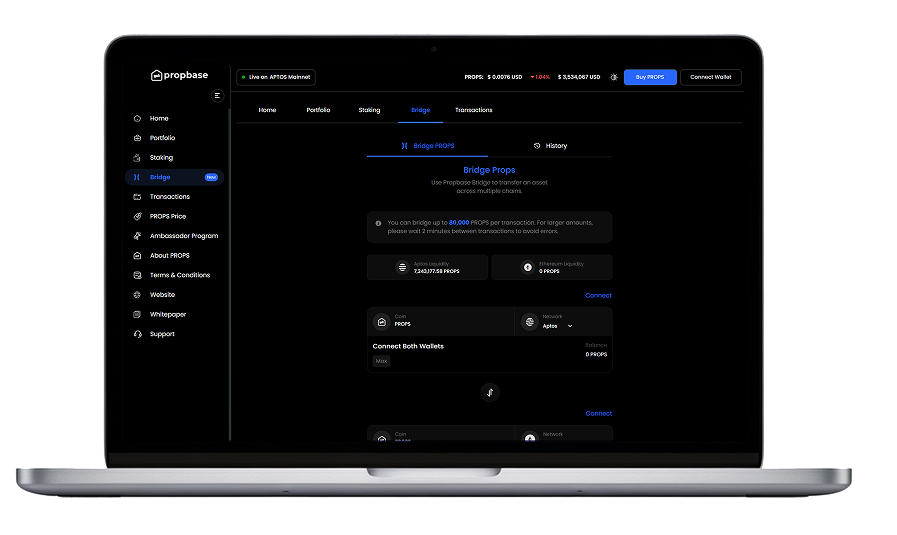

Omnichain Expansion & Cross-Chain Access - Propbase Omnichain Nexus

(LayerZero OApp-Enabled Cross-Chain Access Layer)

- EVM-to-aptos purchase messaging via Layerzero Oapp framework

- Claim-based settlement of property tokens on aptos

- Deterministic claim and staking flows without user-managed bridging

- Single-transaction post-claim staking into rental yield contracts

- Cross-chain activity indexing and transparent state tracking

Application Platform & Experience Scaling

Propbase App 2.0 (IOS & Android)

(Unified Mobile And Web Experience)

- Native Propbase app 2.0 release for IOS And Android

- Full Propbase Yield integration within the mobile app

- LayerZero bridge integration for cross-chain user flows

- Unified mobile and web application architecture

- End-to-end UI/UX overhaul across app and web platform

On-Chain Orderbook - Propbase Limit Engine

- Limit-order wrapper built on clmm positions

- Price-to-tick range translation and order routing

- Order state tracking (open/partial/filled/cancelled)

- Automated execution, auto-close, and settlement flows

- Transparent order history, fills, and fee accounting

Q3 2026 Outcome Summary

By the end of Q3 2026, Propbase significantly expands on-chain participation by combining omnichain access, a fully unified application experience, and advanced trading infrastructure. Omnichain Nexus enables users to acquire property tokens directly from external networks without manual bridging, while Propbase App 2.0 consolidates yield, cross-chain activity, and portfolio management into a single streamlined interface.

The introduction of the Propbase Limit Engine adds structured on-chain trading capabilities, allowing users to place limit orders against property tokens in a transparent and capital-efficient manner. Together, these upgrades reduce friction, improve execution quality, and support higher transaction volumes, reinforcing Propbase's decentralized, user-first design and scaling access, liquidity, and execution velocity.

Q4 2026INSTITUTIONAL SCALE

Q4 2026 focuses on expanding Propbase from single-asset participation to portfolio-scale capital deployment. With velocity, access, and execution layers established, this phase introduces an aggregated asset structure designed to support larger capital flows, deeper on-chain liquidity, and institutional participation while preserving transparent linkage to individual property assets.

"Aggregating Real-World Assets Into Portfolio-Scale, Institutional-Grade Liquidity."

Asset Aggregation & Institutional Infrastructure - XPROPS - Asset-Backed Real Estate Index

(Aggregated Exposure Layer For Institutional-Scale Liquidity)

- Aggregation of multiple property tokens into a single asset-backed index

- On-Chain minting and redemption logic tied to underlying asset composition

- Transparent Weighting and exposure mapping to individual property tokens

- Liquidity architecture optimized for higher notional volumes and TVL growth

- Interoperability with individual assets for yield participation and future utility

Liquidity & Market Infrastructure - XPROPS Liquidity Layer

- Dedicated USDC / XPROPS liquidity pools

- Concentrated liquidity ranges optimized for higher notional volume

- Protocol-supported liquidity bootstrapping and depth management

- Price stability and spread optimization mechanisms

- Integration with mint and redeem execution flows

Application Platform & Trading Experience - XPROPS Trading Interface (UI/UX Overhaul)

- Dedicated XPROPS trading interface and layouts

- Advanced price charts and liquidity visualizations

- Integrated limit orders and execution controls

- Real-time depth, spread, and volume indicators

- Unified trading flows across mobile and web

Q4 2026 Outcome Summary

By the end of Q4 2026, Propbase introduces an institutional-grade aggregation and liquidity layer, enabling portfolio-scale participation across real-world assets. XPROPS concentrates liquidity, supports deeper on-chain markets, and provides a scalable entry point for larger capital—while maintaining transparent connections to individual property tokens. Together, these upgrades position Propbase for higher TVL, improved execution quality, and long-term institutional adoption within a decentralized, asset-backed ecosystem.

ADDITIONAL PLATFORMENHANCEMENTS(2026)

- Fiat on-ramp / off-ramp

- Faster asset onboarding pipeline

- PROPS purchases via USDC yield

- Currency preference selector

- Language selection support

- SEO-Optimized landing pages

- Enhanced price visualization charts

- Rental income simulator tools

- Analytics and performance tracking

- Advanced settings customization

- Interactive real-time notifications

- Investor education and Q&A

- Smart alerts automation center

- In-App, Push, Email Alerts

- Notification preferences dashboard

- Event categorization and prioritization

- Notification audit trail logging

- Rewards system phase two

- Behavior-based loyalty incentives

- Google, Apple, Twitter authentication

- Sub-account wallet management updates

1. Propbase Yield

Stake PROPS, Earn PROPS on our Staking Platform for Passive Income.

2. Propbase Nexus

A Secure Blockchain Crowdfunding Real Estate Tokenization Engine.

3. Propbase Apex

A Next-Gen Real Estate Trading Marketplace. Buy & Sell Anytime, from Anywhere.

4. Propbase Patreon

A Growth-Boosting Module for Scaling Referral and Affiliate Engagement.

Secure Your Spot. Earn Like Never Before.

Get a free Propbase membership, limited spots available to earn up to 40% APY and unlock premium benefits.

Stake PROPS. Support the Ecosystem. Earn Rewards.

Propbase Yield is the exclusive staking platform for PROPS holders, earn passive income, show investor confidence, and help shape future governance decisions.