With main achievements highlighted below

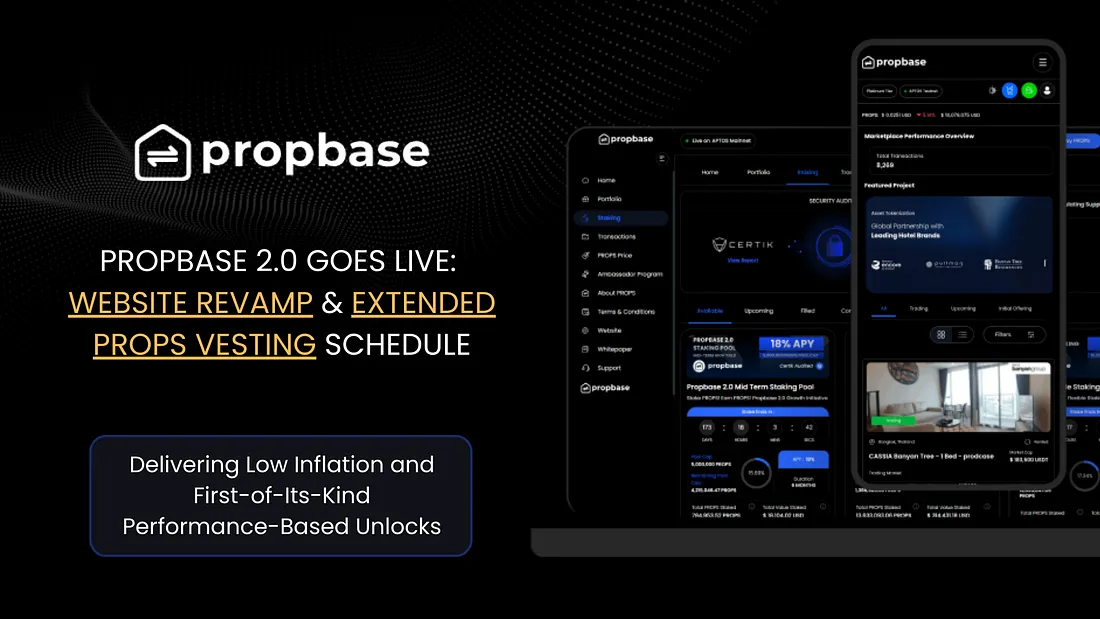

Propbase achieved major upgrades across Front-End, Back-End, and Blockchain layers — including a revamped website, Native USDC integration, improved UX, robust 2FA/KYC, and critical smart contract deployments. With Nexus 2.2.5 live and the Layer Zero Bridge underway, the team is now focused on mobile app development, Lending & Borrowing.

- New Website Revamp (Propbase 2.0)

- Launched Secondary Marketplace (CLMM architecture)

- Completed Certik Audit on all CLMM contracts

- PROPS Tokenomics Extended Vesting 2.0 Live (props vesting tracker tool)

- 3rd Asset offering Sold Out — Ramada (in only 11 hours)

- Integration of USDC native on Aptos (previously Layer Zero)

- Refined liquidity on all Property Tokens (deepened liquidity)

FRONT END

We greatly enhanced our Front-End, revamping the website with new content and pages, and upgrading core apps like Nexus, Nova, and Yield with features like Native USDC support, dynamic token pricing, SDK migrations, and improved UX.

BACKEND

Concurrently, our Back-End team focused on platform stability, deploying Nexus 2.2.5, implementing robust 2FA and KYC flows, and enhancing admin and liquidity management tools.

BLOCKCHAIN

On the Blockchain side, we completed key smart contract deployments, integrated Aptos Native USDC, and initiated the Layer Zero Bridge, laying a stronger, more efficient foundation for all our services.

NEXT 3 MONTH DEVELOPMENT INITIATIVES

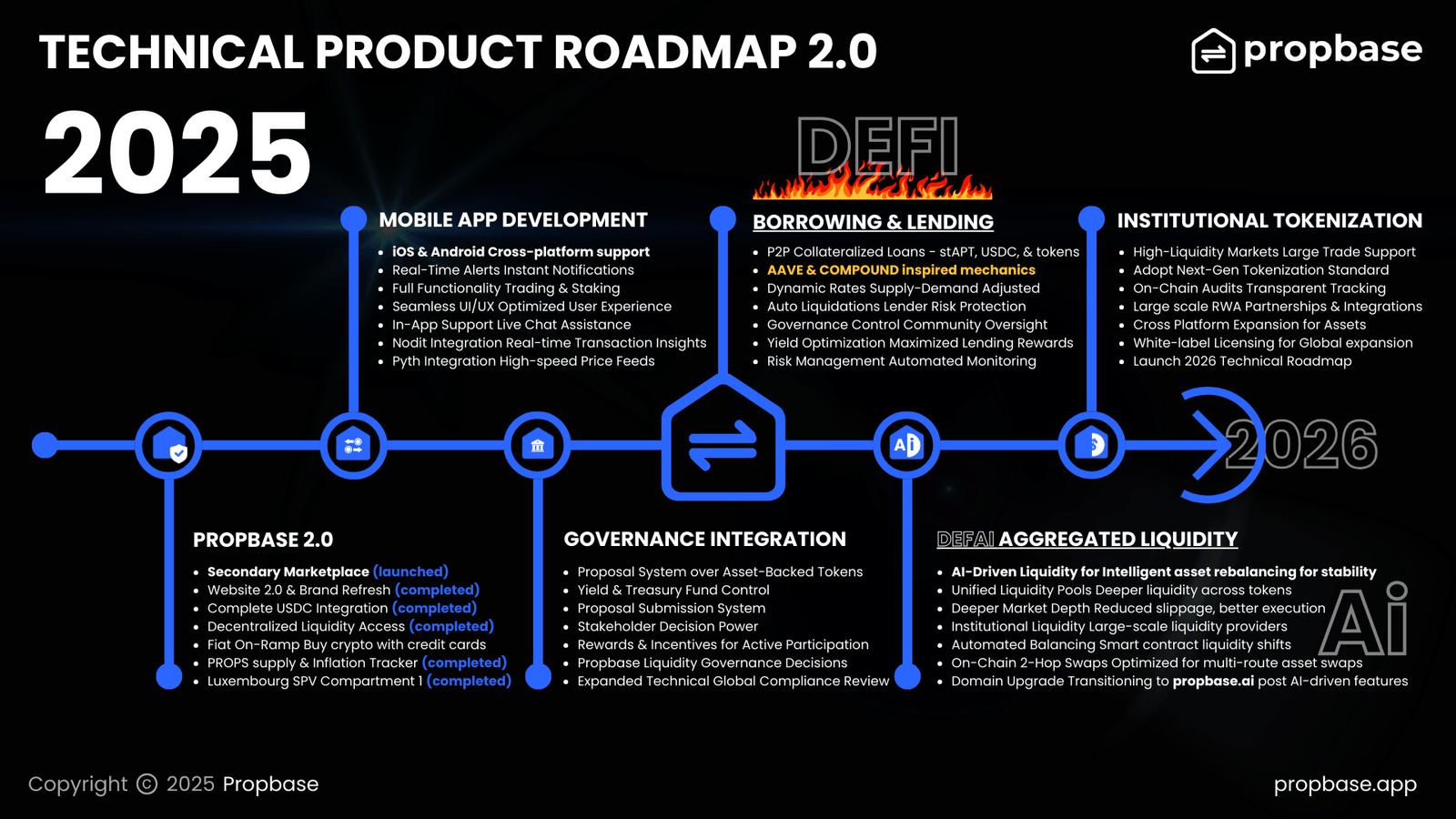

Over the next 3 months the propbase team focus is heavily geared towards mobile application development on Andriod & iOS, Lending & Borrowing, Aggregated Liquidity, and Governance modules all built directly.

Propbase is on track for all technical roadmap activities to be competed on time and ahead of schedule.

Front-End (FE) Updates

1. Website Enhancements

- Homepage — updated metrics added for total investments and investor count.

- Logos on the homepage were replaced with updated versions and the footer redesigned for improved branding.

- About page content updated, including text and images for better user engagement.

- The FAQ page improved with a better layout and clearer answers to common questions.

- New pages like Tokenomics, Blogs, Teams, Careers, Token utility pages, How it works, Roadmaps, Tech, How to buy PROPS, Global compliance pages and their corresponding detail pages are designed and developed and added to production.

- Contact form is developed and created as a new page in the website.

- Integrated new Fungible Asset PROPS on the Nexus Home website.

- Tokenomics content updated to reflect new fee structure and revised investment model.

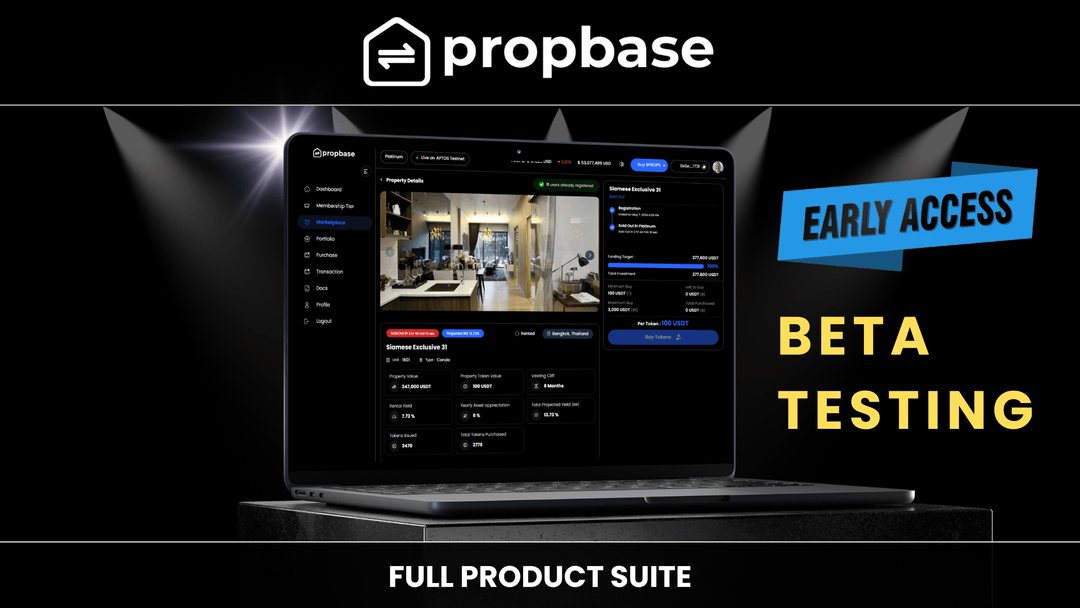

2. Nexus, Nova and Yield app

- Added countdown timer for Rental Yield start time on the property detail and portfolio pages

- SDK migration is complete and tested in Nexus

- SDK migration in the Yield app is completed

- Fee restructuring in Swap and trade is complete, tested and pushed to production

- Dynamic token pricing is now displayed throughout the swap and investment screens

- Total liquidity Graph integration is complete in the property detail page

- Edge case handling added to swap screen logic, ensuring that partial swaps are correctly reflected in the token amounts

- Nexus app primary sale is updated to support Native USDC

- Updated Nexus liquidity page configurations, distribution graph and integrated related APIs

- Enabled socket integration for Nova transaction tables

- Wallet Balance Fetch improvements by adding a backup function to fetch wallet balances

- Error handling improvements

- Holders Count Updates

- Yield App API updates for transaction improvements

- Rental yield distribution logic updated to display fixed USDC values

- Rental yield Native USDC config changes in the app are completed

- Yield calculations and display updates for wallets, showing the accurate earnings per wallet across all pages

- Implemented configuration updates for Rental Yield across interfaces

- Added transaction table updates to reflect the coin type used for Rental Yield

- Addressed and fixed issues with staking calendar display and functionality.

3. Visual & UX Improvements

- Layout issues resolved across several pages, including liquidity page and swap screens

- Formatting improvements made across all values for better consistency and readability

- Several minor UI fixes to ensure smoother transitions between screens and more intuitive interactions for the user

- Improved mobile UX in Yield App’s Portfolio section by ensuring button visibility

- Enhanced liquidity slider component

4. Bug Fixes & General Updates

- Fixed issues with transaction errors on swap and investment screens, improving the reliability of real-time calculations

- Resolved inconsistency in token swap amounts where partial swaps were not correctly reflecting the final token value

- Improved investment success page’s behavior to better display correct figures, reducing user confusion

- Fixed liquidity request cancellation issue and request errors related to Rental Yield

Back-End (BE) Updates:

1. Nexus & Nova Pool Enhancements

- Integrated Swap Event and Swap Fee Event functionality into the platform successfully

- Completed and deployed Nexus version 2.2.5, which includes key updates such as bug fixes for 2FA and overall platform stability improvements

- Developed and tested features for deleting APEX Pools

- Handled fee restructuring logic, including group testing and iterative bug fixes

- Implemented ordered_map functionalities in APEX

- Added Blacklisting in Primary market and APEX

- Addressed critical admin and user functionalities related to adding and removing liquidity, ensuring smooth transaction logging and accurate fee reflection in both environments

- Token holders’ graphs can be enabled and disabled through swagger documents

- Fetched primary sale data (funding target and other KPIs) directly from the blockchain

- Implemented trade transaction wallet address update for admin and user

- Enabled socket broadcast for APEX Swap in detail page transactions

- Integrated DeFi-Llama metrics for Nexus platform analytics

- Improvements in Nexus and APEX functionalities

- Improvements in total Liquidity, TVL and Volume graphs

- Show total base and quote amount data of previously created pool and new pool against single asset

- Display all APEX transactions for deleted pools in the transaction list

2. Website Backend Support & Enhancements

- Implemented backend support for displaying user FAQs on the website

- Addressed frontend API needs for team management, including listing, dynamic priority handling, and image upload support

- Enhanced the reset password flow by fixing expiration logic and improving error messaging

- Total holders count and total transactions KPI’s added to the website

- Released functionality for profile picture uploads, with ongoing improvements based on QA feedback

- Resolved discrepancy in total on-chain holders between Yield app and the home website

- Added support for Coin Market Cap integration to ensure accurate value representation

3. 2FA & Authentication

- Fixed various issues in 2FA email design and layout, centralizing button placement and improving template responsiveness

- Conducted a complete review of the API to prevent data leaks and enhance session management

- Held demos and discussion sessions for better cross-team clarity on 2FA workflows

- Added 2FA new flow including email and authenticator verification features

- Migrated 2FA script to new version and supported related testing

4. Admin Panel, Pool & Liquidity Management

- Delivered graph flow enhancements in the liquidity management module

- Extended admin pool management features to display collected Props, base fee, and quote fee details

- Improved bin-level liquidity logic, addressing edge cases like lowest bin coin additions and distributed token reflections

- Created a new API to re-arrange existing asset images for assets in Nexus

- Allowed system admin to upload Excel, external docs, and videos to the app

- Implemented mechanisms for liquidity rebalancing and provided internal documentation and walkthroughs for the admin team

- Developed a new API for updating basic pool configurations

- Fixed issue in the pool management module

- Implemented admin-side total volume graph API

- Implemented pool management migration script

5. KYC Integration & Wallet Management

- Developed a robust backend system to automatically blacklist wallets that fail KYC during buy, sell, stake, or unstake transactions

- Added real-time sync for blacklist updates across modules, ensuring immediate enforcement across user actions

- Introduced manual override logic for KYC approvals, giving admins visibility and control over user onboarding

6. Rental Yield & Native USDC Integration

- Supported both admin and user modules for managing rental yield configurations involving native USDC

- Delivered features that enable configuration of bin radii ensuring better fund allocation control

- Deployed updates to support yield claims in production, resolving prior calculation and sync issues

- Integrated rental yield logic with manual sync capabilities and provided debugging support for incorrect values in the production environment

- Added new updates to rental yield configuration

- Verified sync for rental yield and APEX properties

- Fetched total staked values in user portfolio and updated graphs using view functions

- Retrieved active and expired pool KPIs using blockchain view functions

- Created a CRON job to validate and auto-resolve DB mismatches in rental yield data

7. Property Upload Enhancements

- Improved the property upload process with stricter validations, support for both image and no-image uploads, and dynamic error handling

- Added backend logic to prioritize uploaded assets, enforce required field checks, and enhance the reliability of the bulk Excel upload mechanism

8. Primary Sale & Native USDC Support

- Completed integrating native USDC into the primary sale module and rental yield, supporting both admin and user-side functionalities

- Addressed internal testing and production issues for yield calculation and transaction management

- Facilitated discussions to refine configuration workflows and ensure compatibility with legacy systems

- Enabled blockchain-based fetching of funding target and KPI data for primary sales

9. Staking App

- Optimised user Staking, Unstaking, Claim rewards, Claim principle APIs

- Created a script for verifying principle and claimed rewards with respect to blockchain value

- Socket implemented – Testing ongoing

- Optimised GET APIs using view functions

10. Internal Demos, QA & Sprint Activities

- Conducted multiple internal demos to walk through new backend functionalities with the broader team

- Supported QA activities by fixing issues related to token distribution, incorrect syncs, and dashboard inconsistencies

- Participated in sprint planning sessions to scope out upcoming modules, prioritize bug fixes, and align on technical dependencies

- Supported Nodeit preparation activities

11. Additional Support & Infrastructure

- Addressed wallet-to-wallet transfer GraphQL scripting and transitioned jQuery-based logic into the main pipeline

- Supported the release and configuration of yield holder count metrics in production

- Resolved customer-reported issues related to the API for asset listings on the home website

- Finalized discussions around sub-account support for wallets, along with DB updates for production-ready asset details

Blockchain Updates:

- Configurations for the second property Cassia token claim were done

- Rental Yield smart contract deployments and configurations were done for the second property Cassia

- Secondary market smart contract deployments and configurations were done for the second property Cassia

- Fee restructuring fixes and testing for the version 2.0 of the secondary market were completed

- Aptos native USDC support is implemented in the rental yield smart contract

- Aptos native USDC support is implemented in the primary market sale smart contract

- Aptos CLI was updated to version 6.2.0 for secondary market smart contract

- All the tests were fixed to support the CLI 6.2.0 updates on the fungible and coin type assets in primary, rental yield and secondary market smart contracts

- Aptos CLI was updated to version 6.2.0 for primary market and rental yield smart contract

- Aptos new data structure ordered_map is used to replace the simple_map data structure in the secondary market smart contract for performance gain

- Development on the Layer Zero Bridge integration has been initiated.

- Developed the Initial draft of single LP Tokens NOVA update

Thank you for reading this quarterly development summary and stay tuned as Propbase ramps up for another marketing campaign and another 3 months of solid product development (estimated at 5,600 hours in additional work enhancing all Propbase Products and offerings)..

Join us on our mission to become the largest and most recognized real estate tokenization platform in SE Asia.